Auto Loan Management Software

Deliver smarter lending experiences with configurable auto finance software built for efficiency and scale. Nortridge empowers lenders and servicers to manage the full vehicle loan lifecycle, from servicing through payoff, with automation, flexibility, and real-time insights.

Request a Demo →

Trusted by Top Brand

Streamline Every Stage of the Auto Loan Lifecycle

A configurable platform that streamlines auto loan servicing, payments, and collections.

Why Nortridge for Auto Loan Management Software?

Nortridge provides auto lenders and servicers with the configurability needed to support any lending model, from direct and indirect lending to buy-here-pay-here and subprime markets. Built to handle complex portfolios and integrations, our software evolves with your business, not the other way around.

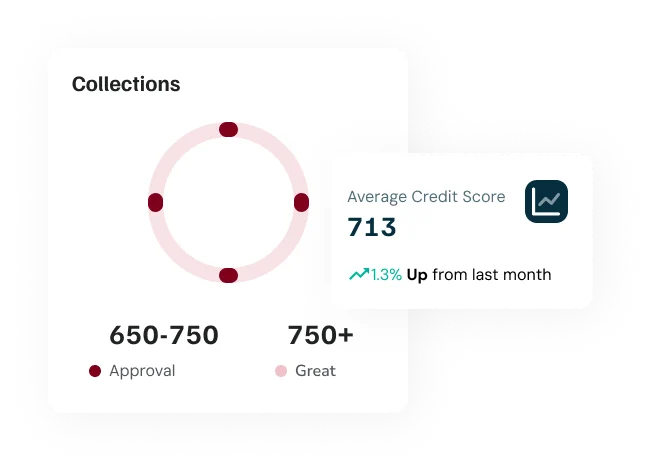

Collections Management

Reduce delinquencies and streamline repossession workflows with configurable late codes, campaign automation, and promise tracking. Nortridge helps auto lenders stay ahead of defaults while improving borrower communication.

Flexible Payment Options

Support your borrowers’ payment preferences with ACH, debit, credit card, or PayNearMe cash payments. Maintain full control over payment waterfalls and application rules, essential for managing diverse auto loan portfolios.

Reporting & Dashboards

Monitor loan performance in real time with over 150 standard reports and configurable dashboards. Get the insights you need to manage risk, track dealer performance, and optimize your auto lending operations.

Workflow Automation

Reduce manual work with rule-based workflows and scripting tools. Nortridge’s automation engine handles servicing processes, from payment posting to delinquency follow-ups, ensuring accuracy across your portfolio.

Success Stories

There is no other solution that brings the out-of-the-box functionality as well as securing future growth with an extensible platform that is evolving and growing to meet future challenges and opportunities.

Allan Hill

Avid Financial

Flexibility with customizations and making the software fit your business needs. Nortridge Support Staff are always knowledgeable and timely with responses.

Carolyn Smith

Credit Central

Software includes a lot of functionality which, if we can use effectively, makes it replace the need for multiple software programs.

Deborah Templeu2028

Communities Unlimited

Ready to Modernize Your Auto Finance Operations?

See how Nortridge can simplify your auto lending operations, reduce manual work, and support your long-term growth.

Frequently Asked Questions

Essential information about our auto lending technology.