Loan Automation Software

Streamline lending with efficient, accurate loan automation tools.

Advanced Automation Solutions for Loan Management

Automation Services

Task Scheduling

Reports & Statements

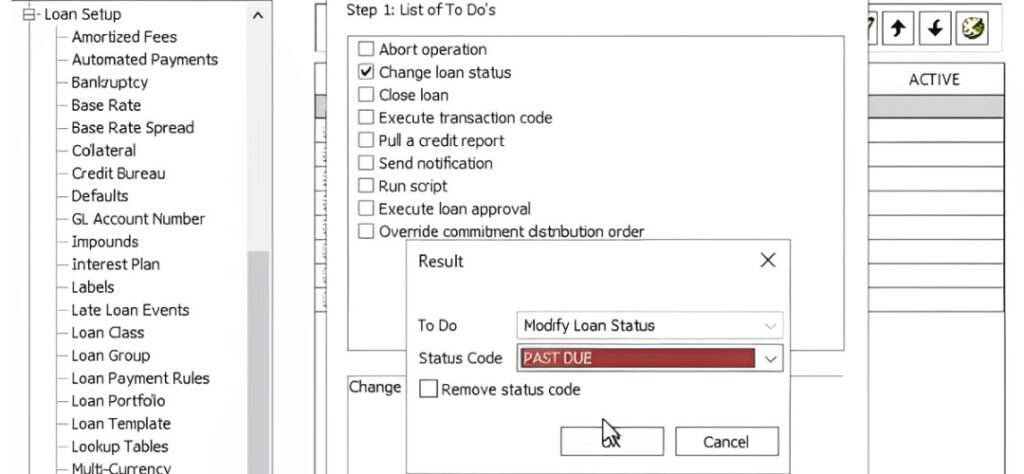

Dynamic Workflow Engine

Save time, reduce errors, and ensure consistent operations with seamless, dynamic, customized workflows.

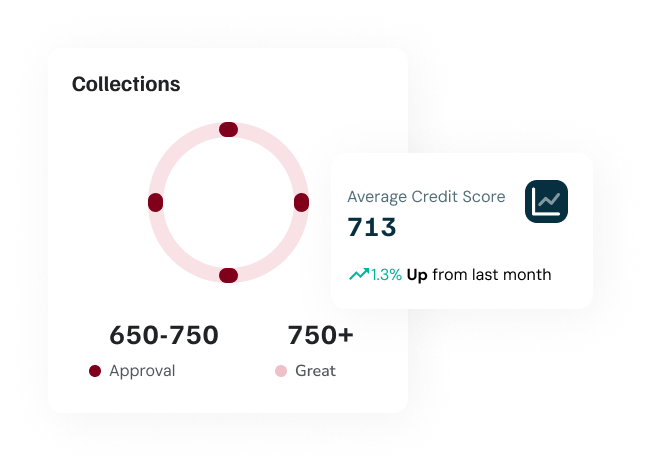

Credit Bureau Reporting

Generate and submit automated credit bureau reports through direct integrations with major credit bureaus. Schedule regular reporting and maintain accurate borrower data.

Smart Notifications System

Never miss a critical update. Automate borrower alerts, internal notifications, and system reminders via email or SMS, ensuring timely communication and smooth loan servicing.

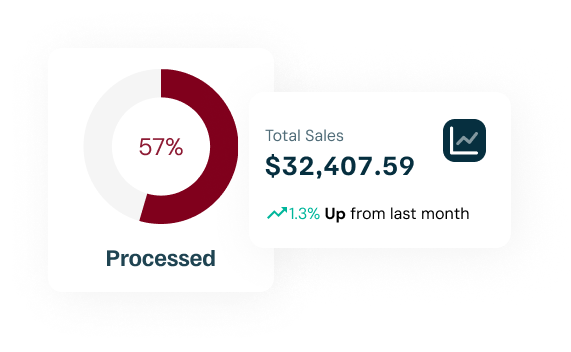

Integrated Payment Automation

Streamline payment collections with automated ACH, recurring credit and debit processing, lockbox integration, and real-time fund distribution.

Frequently Asked Questions

What processes can Nortridge automate?

Nortridge automates repetitive tasks like payment processing, reporting and borrower notifications, freeing up your team to focus on high-value work.

Can I customize workflows?

Yes, Nortridge allows you to create tailored workflows for everything from customized loan approvals to task assignments, ensuring your operations align with your unique needs.

Does Nortridge support automated borrower communication?

Absolutely. Automate borrower alerts and payment reminders through email or SMS, ensuring timely and effective communication.

How does automation improve efficiency?

Automation reduces manual intervention, streamlines operations, and minimizes errors, leading to faster processes, better compliance, and an improved borrower experience.

Our Latest Testimonials

What Makes Nortridge Loan Automation Shine?

Nortridge’s automation solutions streamline loan management by automating repetitive tasks, improving workflows, and reducing manual errors. With advanced tools for process automation, lenders and loan servicers can enhance operational efficiency, ensure compliance and focus on delivering exceptional borrower experiences.