Agriculture Loan Servicing Software

Nortridge provides agricultural lenders with flexible loan servicing tools designed to handle the unique demands of farm financing, from seasonal payment schedules to complex collateral tracking for equipment, livestock, and land.

Request a Demo →

Trusted By Top Brands

Why Nortridge for Agricultural Lending?

Grow your Ag lending operations with ease.

Service Any Agricultural Loan with Nortridge

From annual crop-year commitments with multiple tranches to lines of credit and term loans, Nortridge supports a wide range of agricultural loans. Manage add-ons and buy-downs to support to meet the unique needs of farmers and agribusinesses.

Flexible Payment Options for Seasonal Ag Cash Flow

Support the unique cash-flow cycles of farmers and agribusinesses with flexible payment options. Nortridge enables ACH, card, and cash payments with customizable schedules and rules, making it easy to manage seasonal revenue patterns and keep ag loans on track.

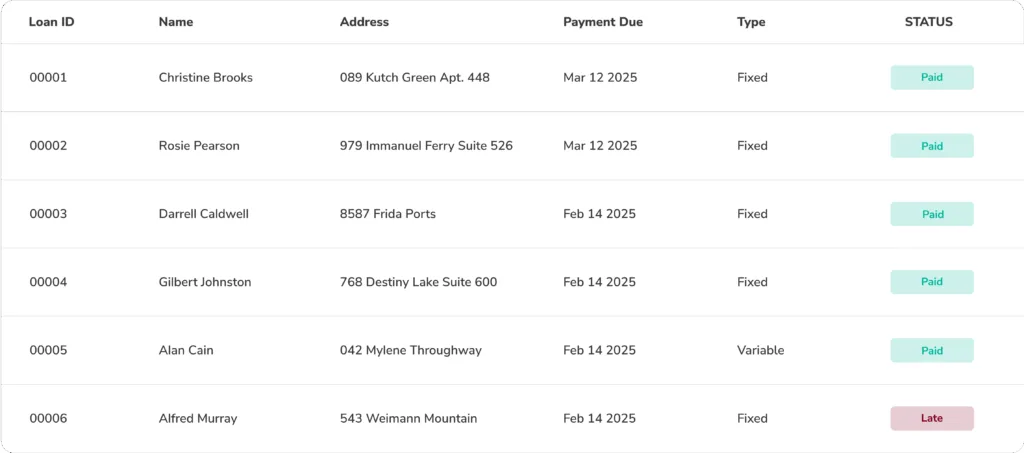

Automate Agricultural Loan Servicing Workflows

Reduce manual work and improve efficiency with automated loan servicing, payment processing and advanced audit capabilities. Nortridge streamlines everything including servicing and collections. Set up custom workflows to ensure loans move smoothly from origination to payoff.

Ag Lending Reporting & Dashboards

Make data-driven decisions with insights into your loan portfolio. Nortridge provides over 150 standard reports to help you track loan performance, and monitor risk and delinquencies. Generate detailed financial summaries and reports to stay ahead in the agricultural lending market.

Frequently Asked Questions

Questions frequently asked by our agricultural lenders.

What features does Nortridge offer for Agricultural lenders?

Does Nortridge integrate the major credit reporting bureaus?

Can Nortridge handle seasonal or irregular payment schedules?

How customizable are loan servicing workflows in Nortridge?

Can Nortridge support multi-party or co-borrower farm operations?

Our Latest Testimonials

Read the latest from lenders and loan servicers using Nortridge to power their lending operations

There is no other solution that brings the out-of-the-box functionality as well as securing future growth with an extensible platform that is evolving and growing to meet future challenges and opportunities.

Allan Hill

Avid Financial

Flexibility with customizations and making the software fit your business needs. Nortridge Support Staff are always knowledgeable and timely with responses.

Carolyn Smith

Credit Central

Software includes a lot of functionality which, if we can use effectively, makes it replace the need for multiple software programs.

Deborah Templeu2028

Communities Unlimited

Transform Your Agricultural Lending with Nortridges

Empower your lending operations with flexible, farmer-friendly solutions designed to support the unique needs of agriculture financing. From custom payment schedules to collateral management, Nortridge gives you the tools to lend with confidence.