Distressed Debt Management Software

The Nortridge Loan System provides distressed debt loan servicers with the tools and solutions they need to succeed in the challenging world of non-performing loan portfolios.

Schedule a Demo →

Why Use Nortridge For Distressed Debt?

Transform your distressed debt operations with precision tracking.

Service Any Distressed Debt with Nortridge

From non-performing mortgages to charged-off consumer loans, Nortridge supports the full spectrum of distressed debt portfolios. Manage complex workout strategies, multiple collateral types and intricate payment arrangements all on one platform.

Automate Your Recovery Process

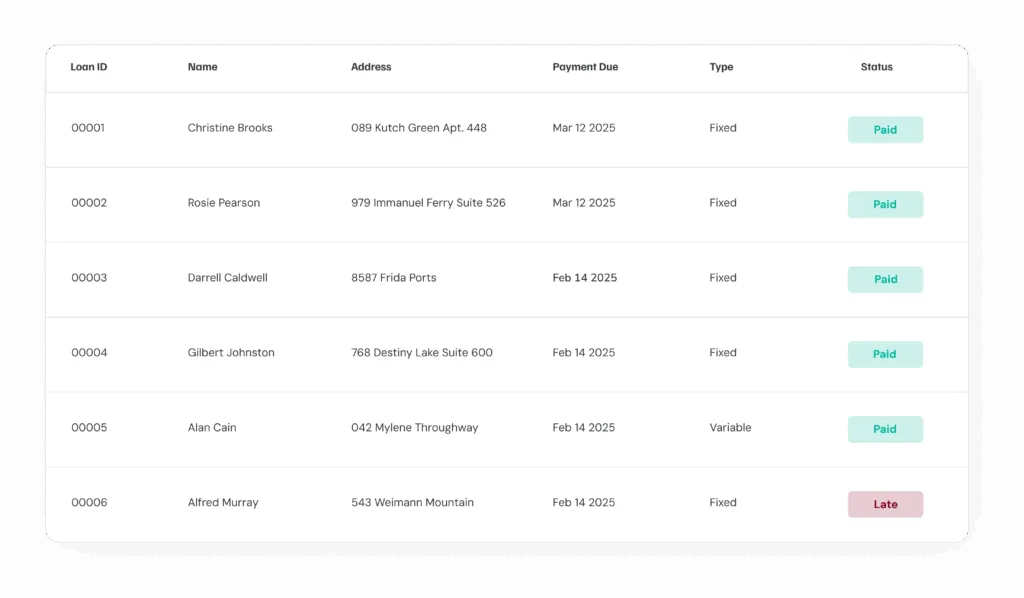

Ditch those spreadsheets and manual tracking systems. Automate payment waterfalls, fee assessment and collection workflows. Set up custom triggers based on payment behavior and let the system handle routine tasks while your team focuses on higher-value recovery activities.

Powerful Portfolio Insights

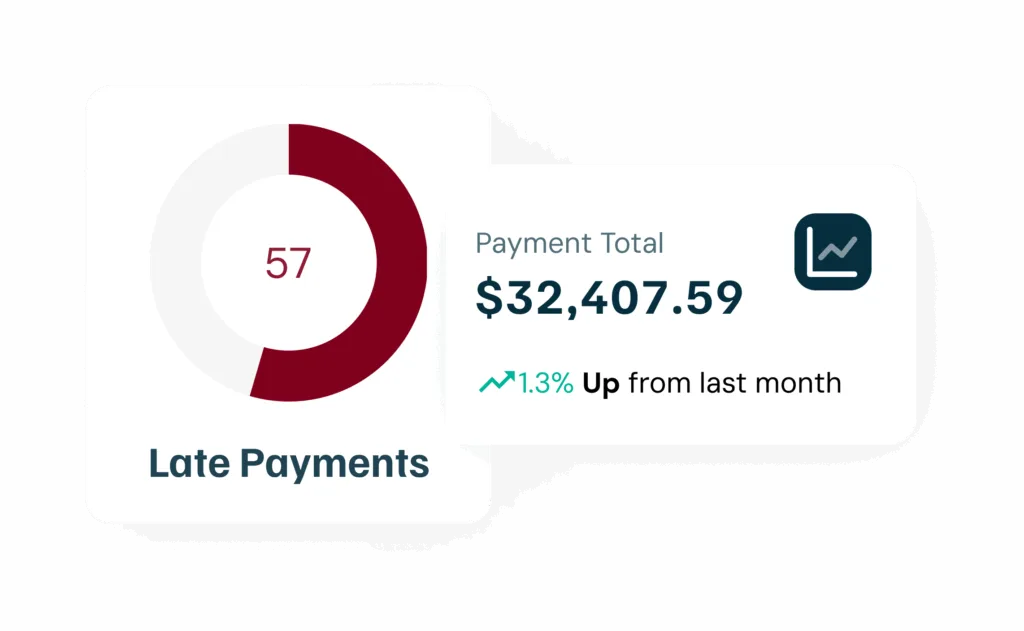

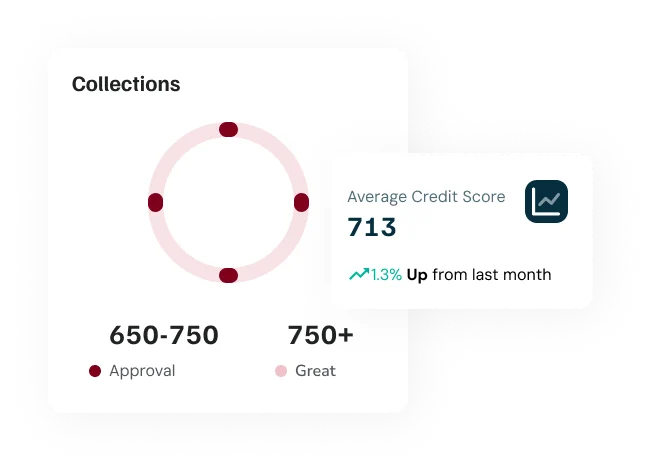

Make smarter investment decisions with detailed analytics showing recovery rates, cost-to-collect metrics and profitability by portfolio segment. Generate configurable reports on performance, trends and forecasts to optimize your distressed debt strategy.

Transform Your Distressed Debt Management with Nortridge

Ready to boost your recovery rates? Let our team show you how Nortridge handles the unique challenges of distressed debt – from tracking multiple asset values to streamlining complex workouts – with a personalized demo tailored to your portfolio.

Frequently Asked Questions

Questions frequently asked by our Distressed Debt loan servicers.

How does Nortridge handle multiple valuation methods for distressed assets?

Can I track expenses related to maintaining distressed assets?

How does collateral tracking work for distressed portfolios?

Can Nortridge handle complex loan restructuring scenarios?

Does Nortridge offer multi-book accounting for distressed debt?

Our Latest Testimonials

Read the latest from lenders and loan servicers using Nortridge to power their lending operations

There is no other solution that brings the out-of-the-box functionality as well as securing future growth with an extensible platform that is evolving and growing to meet future challenges and opportunities.

Allan Hill

Avid Financial

Flexibility with customizations and making the software fit your business needs. Nortridge Support Staff are always knowledgeable and timely with responses.

Carolyn Smith

Credit Central

Software includes a lot of functionality which, if we can use effectively, makes it replace the need for multiple software programs.

Deborah Temple

Communities Unlimited

Trust Nortridge For Your Distressed Debt Management

Stop struggling with cobbled-together spreadsheets and outdated systems. Our comprehensive platform delivers the specialized tools distressed debt professionals need, from purchase cost tracking to collateral management, giving you complete control over your non-performing portfolio.