Loan Management Software

Transform your lending operations with Nortridge’s fully configurable, end-to-end loan management and servicing software.

Schedule a Demo →

Smarter Lending Starts with the Right Loan Management Software

Streamline your lending process with powerful, configurable tools built to scale with your business.

Configurable Loan Products

Nortridge’s software for loan management makes it easy to create and configure loan products without writing code. Set up new loan types, adjust terms, and enter new markets faster.

Adapt to changing borrower needs and business goals with a platform built for flexibility, scale, and speed. Our loan servicing solution supports any loan type with complete configurability.

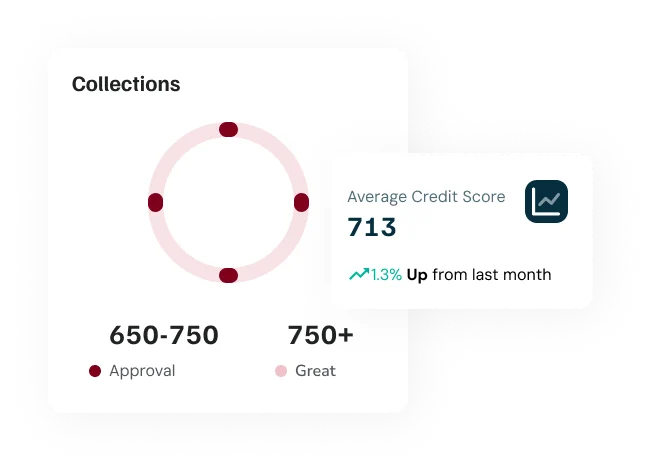

Integrated Collections Module

Improve recovery rates and reduce delinquency with Nortridge’s integrated collections feature, a core part of our loan management software. Automate follow-ups, manage overdue payments, and streamline your collections process through a single loan servicing system.

With advanced workflows and data-driven strategies, Nortridge helps you save time, protect cash flow, and improve borrower accountability using a fully configurable loan servicing solution.

Contact & Borrower Record Management

Manage borrower relationships with precision using Nortridge’s built-in Customer Information File (CIF). Centralize borrower data, documents, communication history, and user-defined fields in one place.

Validate addresses, track every interaction, and configure borrower profiles to match your internal workflows. With Nortridge, your servicing and collections teams always have the full borrower picture with complete audit trails.

Flexible Hosting Options

Manage borrower relationships with precision using Nortridge’s built-in Customer Information File (CIF). Centralize borrower data, documents, communication history, and user-defined fields in one place.

Validate addresses, track every interaction, and configure borrower profiles to match your internal workflows. With Nortridge, your servicing and collections teams always have the full borrower picture with complete audit trails.

Frequently Asked Questions

What is the difference between loan management software and loan servicing software?

Can I customize workflows and loan products in Nortridge's loan management software?

Does Nortridge loan servicing software integrate with other systems?

Does Nortridge offer customer support for its software?

Our Latest Testimonials

Read the latest from lenders and loan servicers using Nortridge to power their lending operations

There is no other solution that brings the out-of-the-box functionality as well as securing future growth with an extensible platform that is evolving and growing to meet future challenges and opportunities.

Allan Hill

Avid Financial

Flexibility with customizations and making the software fit your business needs. Nortridge Support Staff are always knowledgeable and timely with responses.

Carolyn Smith

Credit Central

Software includes a lot of functionality which, if we can use effectively, makes it replace the need for multiple software programs.

Deborah Temple

Communities Unlimited

Why Loan Servicers Choose Nortridge

Lenders and loan servicers trust Nortridge for its powerful, fully configurable loan management software. Our platform supports a wide range of loan types and offers advanced tools for automation, compliance, borrower communication, and performance reporting.

Whether you’re managing consumer loans, commercial lending, or specialty finance, Nortridge adapts to your exact needs, not the other way around. With 40+ years of experience and over $750 billion in active loans managed, we provide the reliability and expertise you need.

Our loan manager software delivers end-to-end lifecycle management with configurable workflows, seamless integration capabilities and comprehensive reporting tools that support your growth.