Features

Explore the Nortridge Platform

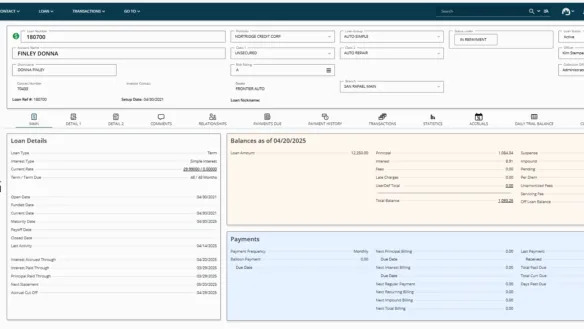

Nortridge offers a configurable, end-to-end loan servicing platform with features built to streamline, automate, and manage the full loan lifecycle with confidence.

Request a Demo →

Trusted By Top Brands

Core Features

Powerful, out-of-the-box features built to streamline every stage of the loan lifecycle.

Add-On Modules

Enhance your platform with advanced modules built for complex portfolios

Integrations & API Capabilities

Nortridge connects seamlessly with third-party tools and internal systems through flexible APIs and pre-built integrations. From payment processing and borrower communication to legal monitoring and data sync, the platform is built for extensibility.

See our list of Loan Software Integrations.