Commercial Lending Software

Enterprise-grade commercial loan management software built to service complex business loans, automate workflows, and scale with growing loan portfolios.

Request a Demo →

Trusted By Top Brands

Transform Your Commercial Lending Operations

Accelerate business growth with commercial lending software built for complex loans, regulatory oversight, and scalable portfolio management.

Why Choose Nortridge Commercial Lending Software?

Nortridge Loan System is built for commercial loan servicers managing complex portfolios that demand control and flexibility. With configurable workflows, support for advanced loan structures, and a platform designed to scale over time, Nortridge brings more than 40 years of proven lending technology experience to commercial loan servicing operations across the nation.

Payment & Fee Management

Manage complex commercial loan fees, payment schedules, and escrow accounts with precision. Nortridge supports amortized fees, multi-tiered late charges, variable interest rate structures, and flexible payment frequencies. Automatically apply payments, maintain accurate loan balances, and track detailed transaction histories across your portfolio.

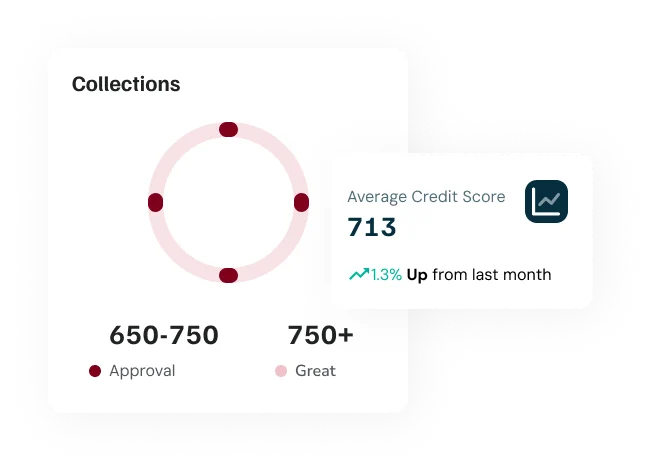

Enterprise Reporting & Analytics

Gain clear visibility into your commercial loan portfolio with powerful reporting and data analysis tools. Generate scheduled reports, review portfolio performance, and maintain detailed audit trails to support internal reviews and operational oversight.

Data Access & Export

Maintain full ownership and access to your loan data. Connect third-party analytics tools directly to Nortridge’s database or export raw data to your data warehouse. Easily synchronize portfolio data from your system of record to support advanced analysis and business intelligence.

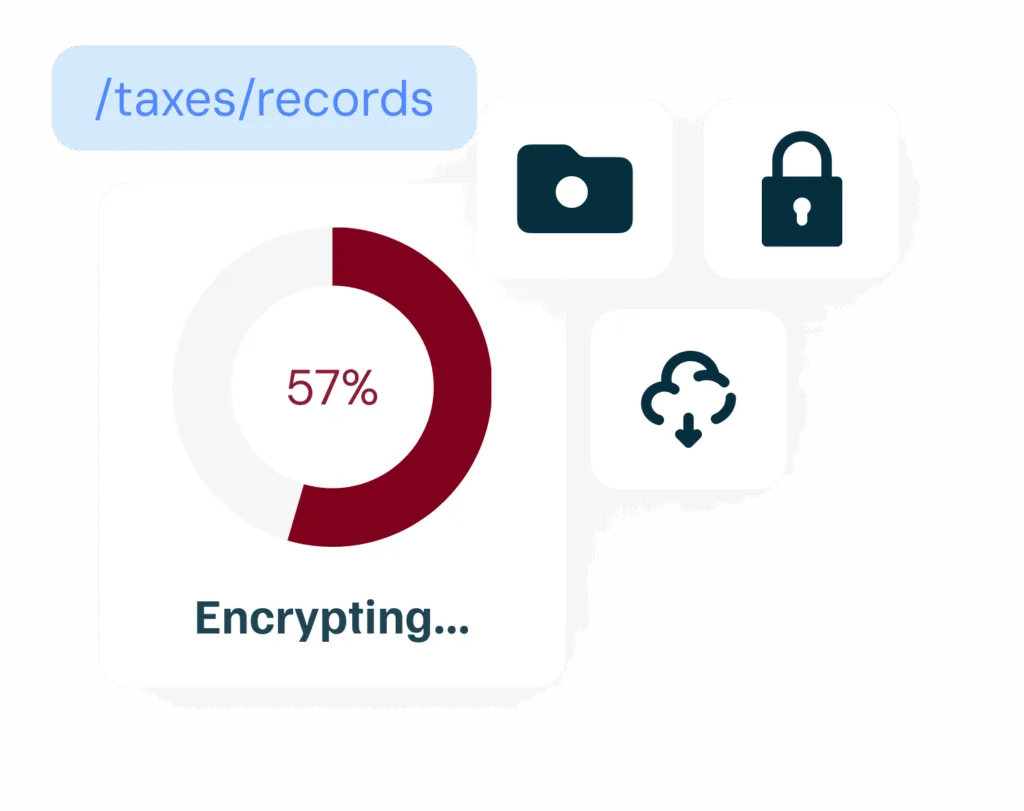

Secure Document Management

Store, organize, and manage commercial lending documents securely within Nortridge. Track loan agreements, collateral files, and supporting documentation using a structured filing system. Maintain easy access to critical records while supporting your document retention and compliance requirements.

Our Latest Testimonials

Read the latest from lenders and loan servicers using Nortridge to power their lending operations

There is no other solution that brings the out-of-the-box functionality as well as securing future growth with an extensible platform that is evolving and growing to meet future challenges and opportunities.

Allan Hill

Avid Financial

Flexibility with customizations and making the software fit your business needs. Nortridge Support Staff are always knowledgeable and timely with responses.

Carolyn Smith

Credit Central

Software includes a lot of functionality which, if we can use effectively, makes it replace the need for multiple software programs.

Deborah Temple

Communities Unlimited

The Advantage of Nortridge Commercial Lending Software

Manage complex commercial loan portfolios with software designed for flexibility, control, and scale. Nortridge gives commercial lenders the tools they need to streamline servicing, maintain oversight, and grow with confidence.

Frequently Asked Questions

Essential information about our commercial lending solution.