Loan Servicing Software for CDFIs and Non-Profits

Loan servicing software that helps you craft loan products that fit your borrowers’ financial needs.

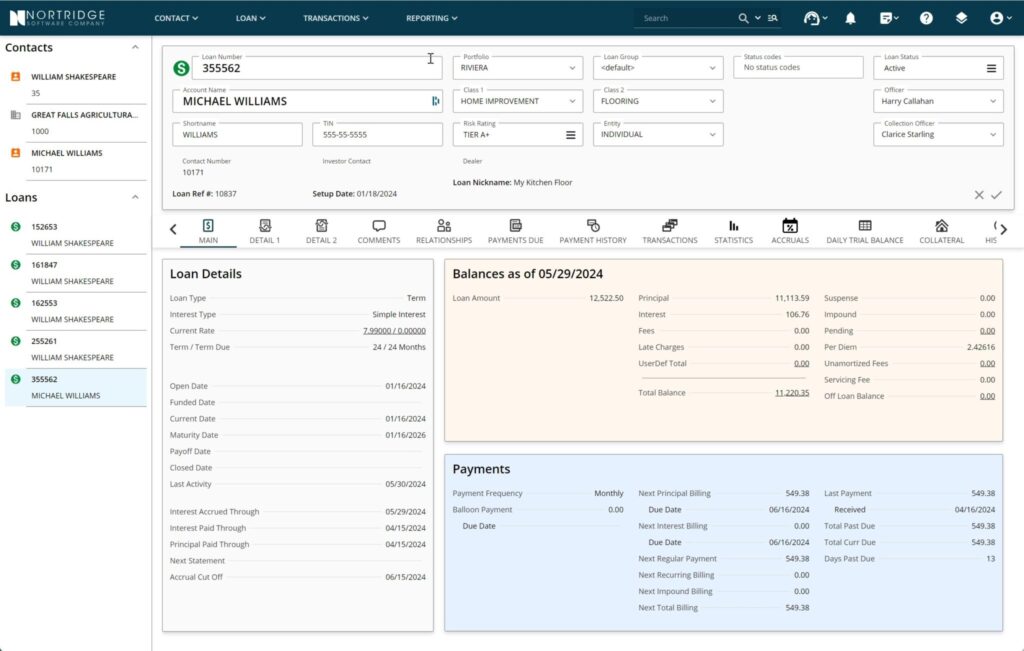

Flexible Loan Configuration

Highly configurable loan products are at the core of Nortridge.

Create Flexible Loan Products

Amortized payments, simple interest, interest-only, percentage and fixed-principal reductions, interest-only beginning periods, step payments, and custom payment schedules.

Multiple Interest Options

Handles fixed, variable, compound, step-by-amount, step-by-days, post-maturity, default rates, deferred, and payment-in-kind (PIK) interest.

Bank-grade security

Keep your data secure with a combination of strong security architecture including data encryption at rest and only using secure connections (TLS 1.2/https) and software features like role-based authorization and strong audit trails.

- Role-based security controls

Data encrypted at rest + HTTPS/SSL 1.2

SOC II compliant

Schedule a Demo Today

Take Nortridge for a test drive and see how it can help streamline your lending operations.