Mortgage Lending Software

A flexible mortgage loan servicing platform designed to support today’s mortgage lenders with configurable workflows, reporting, and portfolio oversight.

Request a Demo →

Trusted By Top Brands

Mortgage Loan Servicing Capabilities

Built to support the full mortgage servicing lifecycle, Nortridge provides flexible tools to manage escrow, payments, and compliance with accuracy and control. These core mortgage loan servicing capabilities help lenders streamline operations while maintaining visibility across their portfolios.

Why Choose Nortridge Mortgage Lending Software?

Nortridge Loan System is built for mortgage servicers managing complex, long-term portfolios. With configurable servicing workflows, proven escrow and payment tools, and a platform designed to scale, Nortridge brings over 40 years of lending technology experience to mortgage loan servicing across the nation.

Escrow & Disbursement Management

Manage escrow balances, insurance, taxes, and disbursements with automated calculations and accurate tracking across each loan.

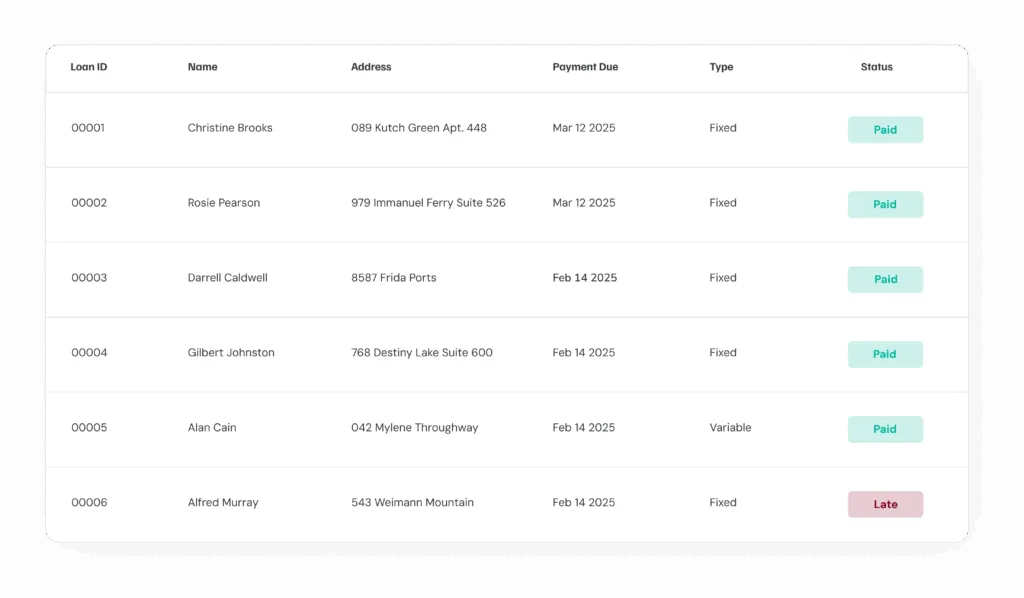

Mortgage Payment Processing & Lockbox Support

Process mortgage payments through ACH, checks, lockbox, and third-party channels. Apply payments accurately, manage partial and effective-dated transactions, and maintain complete payment histories across your servicing portfolio.

Secure Document & Disclosure Management

Manage mortgage documents and disclosures within Nortridge’s secure hosting environments. Maintain organized records, controlled access, and document retention practices that support internal reviews and servicing requirements.

Our Latest Testimonials

Read the latest from lenders and loan servicers using Nortridge to power their lending operations

There is no other solution that brings the out-of-the-box functionality as well as securing future growth with an extensible platform that is evolving and growing to meet future challenges and opportunities.

Allan Hill

Avid Financial

Flexibility with customizations and making the software fit your business needs. Nortridge Support Staff are always knowledgeable and timely with responses.

Carolyn Smith

Credit Central

Software includes a lot of functionality which, if we can use effectively, makes it replace the need for multiple software programs.

Deborah Temple

Communities Unlimited

Nortridge’s Mortgage Lending Advantage

Nortridge delivers mortgage lending software built for long-term servicing success. With flexible configuration, proven servicing tools, and enterprise-grade reporting, lenders can manage complex mortgage portfolios with confidence.

Frequently Asked Questions

Questions frequently asked by our Mortgage lenders.