Medical Loan Servicing Software

The Nortridge Loan System provides robust white-labeled solutions for medical, dental and surgical practices, supporting the unique requirements of healthcare financing with precision and security.

Schedule a Demo →

Why Use Nortridge For Medical Loan Servicing?

Transform your healthcare financing operations with specialized tools.

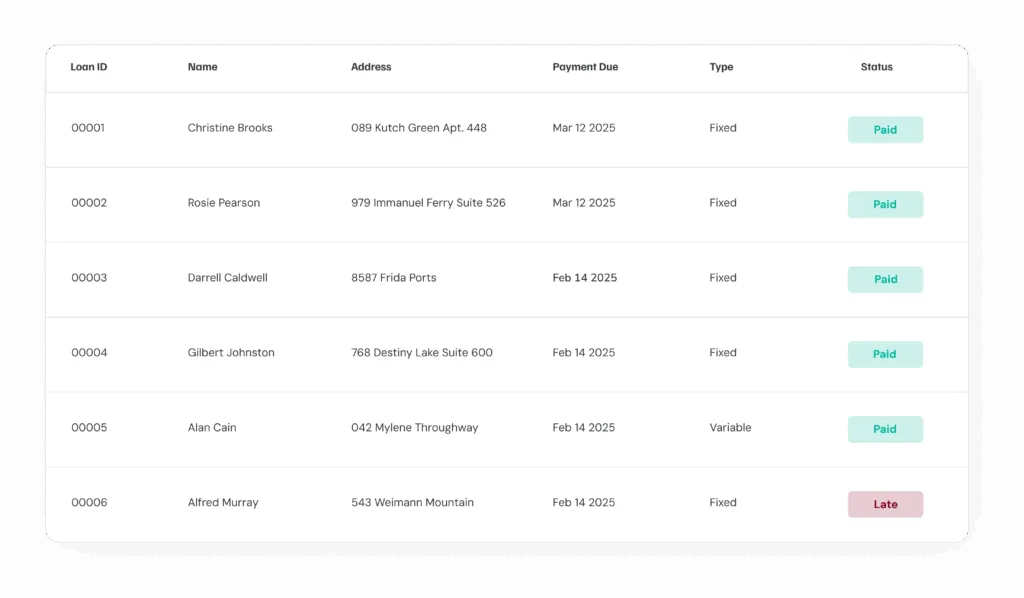

Service Any Medical Loan with Nortridge

Support diverse healthcare financing needs with configurable terms and structures. Adapt loan features to match specific medical lending requirements for dental, orthodontic, elective procedures and insurance deficiencies.

Loan Payment Processing

Process payments through multiple channels with integrated payment solutions. Streamline your medical loan processing with automated payment workflows and efficient transaction management.

Portfolio Analytics

All 150+ detailed reports can be generated by the provider, on loan performance and patient financing metrics for all services.

Transform Your Healthcare Financing with Nortridge

Ready to see how our medical loan servicing platform can streamline your operations? Let our team show you how Nortridge can support your specific healthcare financing needs with a personalized demo.

Frequently Asked Questions

Questions frequently asked by our Medical lenders.

How does Nortridge handle multiple parties related to the loan?

What payment processing options are available?

Can a system be white-labeled by practice?

Does Nortridge offer support and training?

Our Latest Testimonials

Read the latest from lenders and loan servicers using Nortridge to power their lending operations

There is no other solution that brings the out-of-the-box functionality as well as securing future growth with an extensible platform that is evolving and growing to meet future challenges and opportunities.

Allan Hill

Avid Financial

Flexibility with customizations and making the software fit your business needs. Nortridge Support Staff are always knowledgeable and timely with responses.

Carolyn Smith

Credit Central

Software includes a lot of functionality which, if we can use effectively, makes it replace the need for multiple software programs.

Deborah Temple

Communities Unlimited

Trust Nortridge With Your Medical Loan Servicing

Empower your healthcare financing with solutions designed for medical lending. From configurable loan products to comprehensive servicing, Nortridge provides the tools you need to serve your patients.