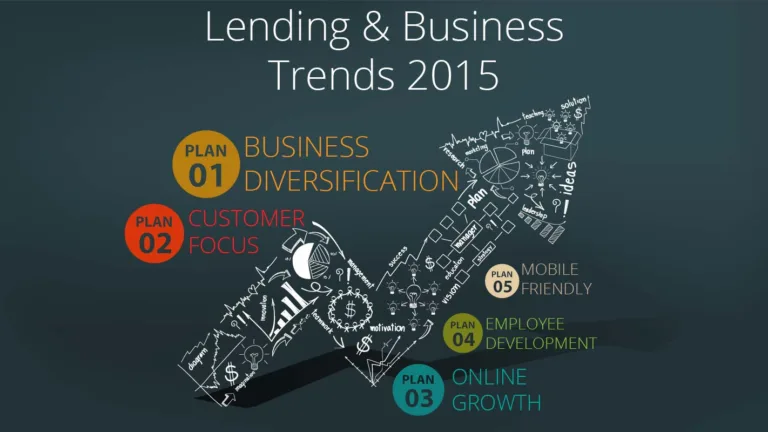

Top Lending Trends to Watch in 2015

There are a number of lending trends to watch. We present several here that we saw in 2014 and expect to carry on into 2015. We arrived at them from the conversations we’ve had with our customers and from the changes we’ve noticed in the industry. However, none of the predictions are unexpected. It’s worth mentioning there are two business shifts that every company should pay attention to even though they affect more than the lending industry.

Changing Business Models

The first trend is a change in business models. As a macro-economic trend, successful businesses are moving away from ‘turn-key’ business models that dominated the 90s. These are businesses that used business models that put a focus on creating a ‘system’ and processes that made employees interchangeable and kept the value in the business model rather than employees, hence the turn-key name. It made sense at first because the ‘system’ made scaling and consistency much easier. Think McDonalds and franchises, the value is in the system, i.e. the processes the employees follow, and it helps create consistentcy, a Big Mac is the same everywhere you go.

On the other hand, to be successfully at lending in the coming years means switching gears to a business model that suites the new business climate. Successful lenders are now placing significantly more value on employees and employee development instead of a ‘system.’ This is because in order to remain competitive, lenders now have to rapidly change, adapt and iterate. Successful execution of initiatives requires top talent and a top team. A successful implementation team means they need to have the ability to change direction on a moment’s notice which places much of the decison making on the overall team. So a new lender will have a much flatter organization structure, a significantly stronger emphasis on hiring better talent, and more fluid communication accross the company. All of which are very different from the top-down management approach that dominated the 80’s and 90s.

Focus on Customers

The second trend we see is a renewed focus on customers. You know that old saying ‘customers are always right?’ Well, it’s making a comeback. If we put together the Internet, mobile, buying behavior and social media (instant mass communication), we get one overwhelming idea: Lenders need to focus on building customer relationships. I mention customer relationships because that’s exactly what it is. It’s much more than sending an email to a customer about a new low interest offer or special financing. Normally, lenders would try to increase ‘lifetime customer value’ and remarketing practices in order to maximize the value they can get of each customer acquisition. In other words, lenders phrase their customer service as ‘let’s get the most we can out of each customer’.

Those days are gone. With the amount of information that lender’s customers have accesss to tied with their ability to communicate en-mass through social media, the only way lenders can success is by truly becoming focused on their customer’s interest first. Truly competitive lenders will create a great customer experience on their website and on all devices. The origination process, customer service and re-marketing will be seamless. Every single customer contact point will be well polished.

Money, and therefore lending, is a commodity. A true focus on customers has been dismissed by the lending industry as COGS (Costs of Good Sold). The lenders that are first to shift to a true customer centric strategy will be the first to develop their competitive advantage in the new lending landscape of 2015 and on.

[Update from June 2015 – Take a look at the approach that American Express and Capital One are doing. Their customer centric approach has already set them apart from the competition.]

Drive toward Diversification

Lenders are diversifying – especially subprime lenders. Conversations with our customers tell us that subprime lenders are diversifying more, and this trend will continue into 2015. Deep subprime lenders like payday lending companies are moving into title loans and online lending. Some of it is due to regulations that target payday loan companies. In most states, there is a cap on the maximum amount that can be loaned as a payday loan and a cap on the fees that can be assessed.

Migration to Mobile

Mobile is becoming critical for lenders to remain competitive, but one can argue that it has been critical for the last few years, if anything this year cements its importance. Having a portal that lender’s customers can use to view their balance, transactions, and make payments is becoming critical to remain competitive. In the past few years we’ve seen a huge push for mobile-friendly websites, and easy-to-use mobile applications. This is partly due to the growth and switch from desktops and laptops to the use of mobile devices. A recent Pew Research report says that well over half of Americans own a smart phone capable of downloading apps and browsing the Internet. Having a mobile site or an app can lower the amount of call volume and strengthen the relationship lenders have with borrowers.

Online Lending Grows – Including Peer to Peer (P2P)

Online and peer-to-peer (P2P) lending continues to solidify as an industry. Online lenders and P2P lending are hot new business model, with good reason. These models leverage the web and explosive growth in mobile devices to originate loans in a way that brick and mortar business can’t do. They are able to minimize the overhead costs by not having a store-front and employee costs associated with traditional lending. Not only that, they are also able to leverage proprietary origination scoring algorithms that promise a better loan portfolio. In addition, they can leverage their online presence to offer lending products nationwide – ensuring we’ll see continued growth in this segment.

Thanks to Lending Club, Square, and Apple’s new payment system, the financial industry is getting a lot more attention than in the past. I’m sure this will provide more opportunities, along with more competition. As always, the best way to predict the future is to create it. Next year, we hope to write about the lending industry trends that you have set.