Participations Loan Servicing Module

Share loan funding across multiple institutions while maintaining complete visibility and control.

Schedule a Demo →

Why Use Nortridge’s Participation Loan Module?

Transform your participation loan management with flexible funding options and automated distribution.

Automated Payment Processing

Say goodbye to writing checks by hand. Payments to participants can be processed through ACH or automatic check disbursement. Schedule them, forget them, and let the system handle the rest – your funding partners get paid on time, every time.

General Ledger Integration

Keep your accountants happy. The system automatically generates General Ledger entries for each participant, making reconciliation a breeze. Your books stay clean and accurate, and audit time becomes much less stressful.

Visualize Delinquency Trends

Stay ahead of risk with dashboards that track delinquency status by region, average days past due, and collection performance to support proactive strategies.

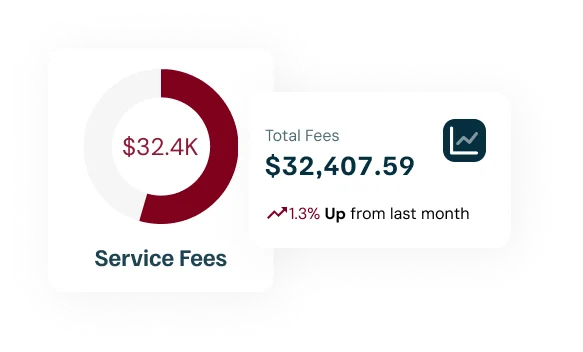

Servicing Fee Tracking

Don’t leave money on the table. Our system carefully tracks all servicing fees associated with participation loans. You’ll always know exactly what you’ve earned for managing these complex arrangements – no more guesswork or missed revenue.

Frequently Asked Questions

How does the percentage vs. dollar amount participation work?

How are payments distributed to participants?

Does the system handle the accounting entries?

Can participants have different terms from each other?

Our Latest Testimonials

Read the latest from lenders and loan servicers using Nortridge to power their lending operations

There is no other solution that brings the out-of-the-box functionality as well as securing future growth with an extensible platform that is evolving and growing to meet future challenges and opportunities.

Allan Hill

Avid Financial

Flexibility with customizations and making the software fit your business needs. Nortridge Support Staff are always knowledgeable and timely with responses.

Carolyn Smith

Credit Central

Software includes a lot of functionality which, if we can use effectively, makes it replace the need for multiple software programs.

Deborah Temple

Communities Unlimited

Streamline Your Participation Loans with Nortridge

Why struggle with complex manual calculations and payment tracking? Our Participations Module handles the heavy lifting of managing multi-source loans, freeing your team from spreadsheets and letting you focus on growing your participation network.