Micro-Finance Loan Servicing Software

The Nortridge Loan System empowers micro-finance lenders with robust tools and solutions to thrive in community-focused lending operations.

Why Use Nortridge For Micro-Finance Loan Servicing?

Flexible Loan Amounts

User Defined Fields

Multi-Currency Support

Powerful Reporting

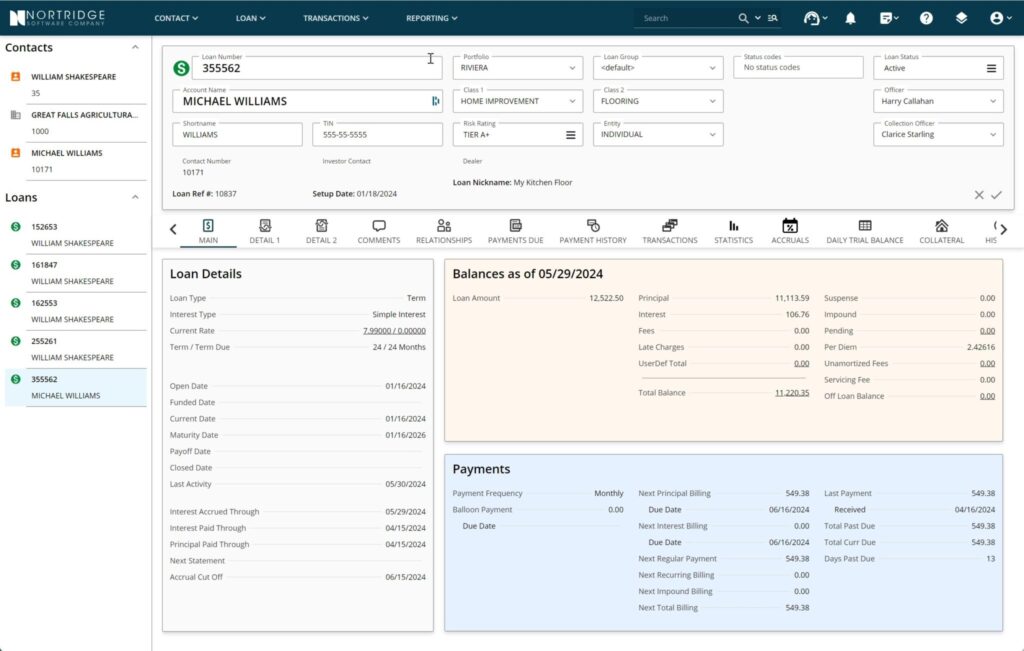

Service Any Micro-Finance Loan with Nortridge

Support diverse micro-finance products with configurable terms and structures. Easily manage loans of any amount with flexible terms to serve your community.

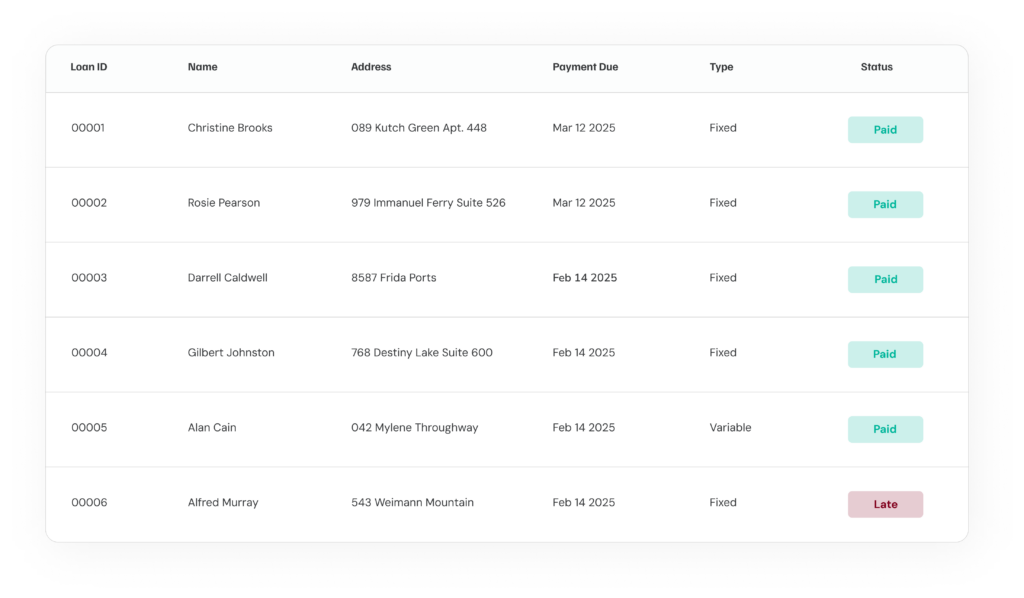

Automate Your Lending Processes

Reduce manual work and improve efficiency with automated loan servicing and payment processing. Nortridge streamlines operations from start to finish with configurable workflows.

Comprehensive Reporting & Analytics

Access detailed insights into your loan portfolio. Nortridge provides over 150 standard reports to help you track loan performance and monitor your business metrics.

Transform Your Micro-Finance Operations with Nortridge

Ready to see how our platform can enhance your community lending? Let our team demonstrate how Nortridge can configure to your unique micro-finance requirements with a personalized demo.

Frequently Asked Questions

What features does Nortridge offer for Micro-Finance lenders?

Nortridge offers many features that benefit micro-finance lenders such as the ability to handle loans of any amount, multiple currencies and flexible payment processing options.

Can I get a personalized demo showcasing Micro-Finance-specific features?

Yes, you can! We ensure that our demo walkthroughs are personalized and relevant to your unique lending operations.

Does Nortridge offer help and support?

Nortridge offers US-based support across the entire product. If there is a special feature or solution needed, Nortridge has a consulting team available.

Does Nortridge have an API?

Yes, our API is extensive and utilizes REST making it a first choice for many developers seeking a solution that is easy to work with without sacrificing capabilities.