Loan Servicing Software

Streamline your lending process easily with Nortridge’s robust loan management and servicing software.

Service Loans Efficiently

Automation & Workflows

Compliance & Risk Management

Reporting & Analytics

Loan Origination

Configurable Loan Products

Nortridge’s software for loan management makes creating and modifying loan products a breeze. With an intuitive user interface, you can quickly set up new loan types and expand into new markets without the need for any coding. This flexibility helps you adapt to changing borrower needs and industry trends. Streamline your operations by customizing your lending process to fit your business goals.

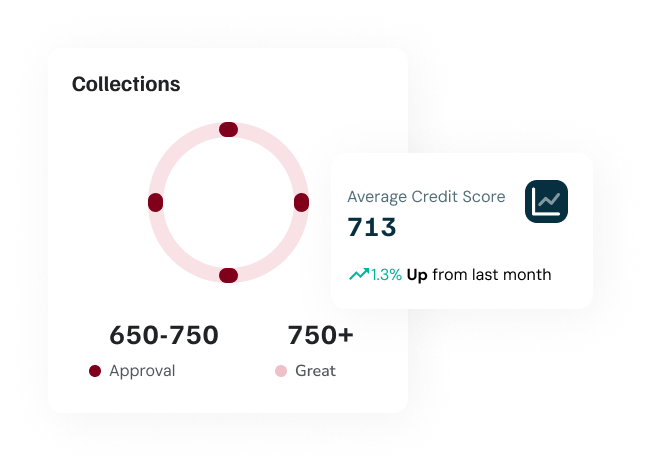

Integrated Collections Module

Improve your collection rates with Nortridge’s fully integrated collections module. This feature allows you to efficiently manage overdue payments, automate follow-ups, and continuously optimize your collections process. By reducing delinquency and automating workflows, you can free up valuable time and resources, improving your overall cash flow and ensuring borrower accountability. Stay ahead by leveraging data-driven collections practices that evolve with your business.

Multi-Channel Communications

Nortridge facilitates effortless borrower communication across text, email, and paper channels. Every interaction is recorded, enhancing service quality and building lasting relationships.

Flexible Hosting Options

Nortridge offers multiple hosting options to suit your business needs. Whether you prefer self-hosting on-premise or cloud-based hosting by us, we provide a secure, scalable infrastructure. Choose the model that best fits your operations.

Frequently Asked Questions

How does Nortridge handle different loan types?

Our platform supports various loan types, from personal and auto loans to mortgages and commercial lending.

Is Nortridge’s Loan Management Software secure?

Yes, Nortridge uses advanced security protocols to ensure your data remains protected and compliant.

How can Nortridge improve my borrower communications?

Our built-in communication tools enable personalized borrower messages and automated payment reminders, enhancing the borrower experience.

Does Nortridge offer customer support for its software?

Yes, Nortridge provides dedicated support, including access to a knowledge base, training videos, and a responsive support team to ensure your system runs smoothly.

Our Latest Testimonials

Why Choose Nortridge

Lenders and loan servicers across industries trust Nortridge for its fully configurable, powerful loan management software. Our platform supports diverse loan types and offers tools for automation, compliance, and reporting. We are loved by many for so many reasons.