Loan Automation Software

Automate your loan servicing workflows with tools that reduce manual work and support consistent, accurate processing. Nortridge loan automation software helps lenders streamline recurring servicing tasks and maintain predictable, reliable operations.

Request a Demo →

Advanced Automation Tools for Loan Management

Automate repetitive loan servicing workflows, reduce manual tasks, and support accurate processing with integrated tools built to streamline routine steps across your loan management system.

Dynamic Workflow Engine

Automate complex loan servicing workflows with configurable, rule-based triggers. Reduce manual steps, support consistent task execution, and keep each stage of your loan management process aligned with your operational requirements.

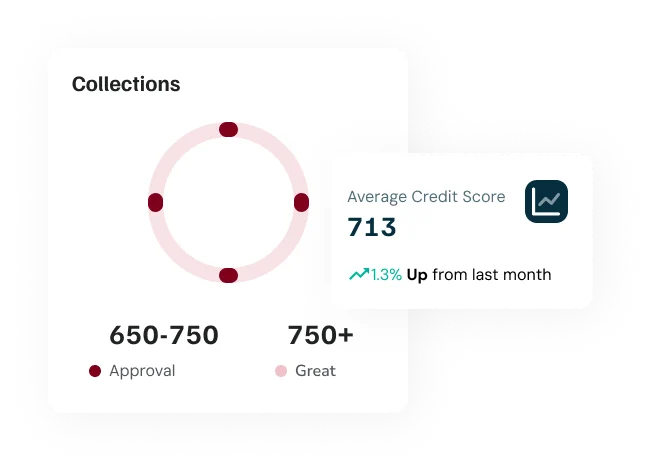

Credit Bureau Reporting

Automate credit bureau reporting through scheduled Metro2 file generation. Create recurring submissions, support accurate borrower data, and maintain predictable reporting workflows with consistent processes for major credit bureaus.

Smart Notifications System

Automate borrower alerts, internal team notifications, and system reminders through email or SMS. Support timely communication, reduce repetitive manual tasks, and keep each step of your loan automation workflow synchronized with servicing activity.

Integrated Payment Automation

Automate payment collections with ACH, recurring credit and debit processing, and lockbox integrations. Reduce manual posting, support accurate transaction handling, and maintain smooth, reliable payment workflows across your servicing processes.

Frequently Asked Questions

Get answers to common questions about automating your loan management processes.

What processes can Nortridge automate?

Can I customize loan automation workflows?

Does Nortridge support automated borrower communication?

How does automation improve loan servicing efficiency?

Does Nortridge integrate with other systems for automation?

Our Latest Testimonials

Read the latest from lenders and loan servicers using Nortridge to power their lending operations

There is no other solution that brings the out-of-the-box functionality as well as securing future growth with an extensible platform that is evolving and growing to meet future challenges and opportunities.

Allan Hill

Avid Financial

Flexibility with customizations and making the software fit your business needs. Nortridge Support Staff are always knowledgeable and timely with responses.

Carolyn Smith

Credit Central

Software includes a lot of functionality which, if we can use effectively, makes it replace the need for multiple software programs.

Deborah Templeu2028

Communities Unlimited

Why Nortridge Excels at Loan Automation

Nortridge automates repetitive servicing tasks, supports consistent workflows and reduces manual work across the loan lifecycle. With powerful automation tools for loan management, lenders can streamline operations and maintain reliable, predictable servicing processes.

Book a Demo of Our Loan Automation Software

See how Nortridge automates loan workflows, reduces manual effort and supports a smoother, more efficient servicing process.