Distressed Debt Management Software

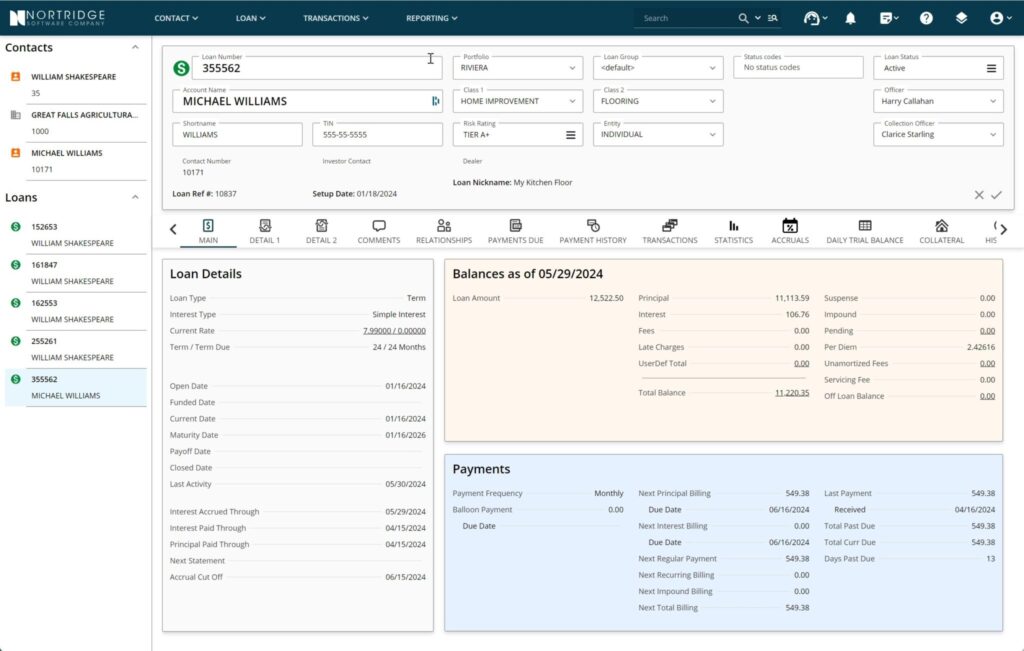

The Nortridge Loan System provides distressed debt loan servicers with the tools and solutions they need to succeed in the challenging world of non-performing loan portfolios.

Why Use Nortridge For Distressed Debt?

Multi-Value Loan Tracking

Protective Advance Management

Profit Analytics

Comprehensive Collateral Tracking

Service Any Distressed Debt with Nortridge

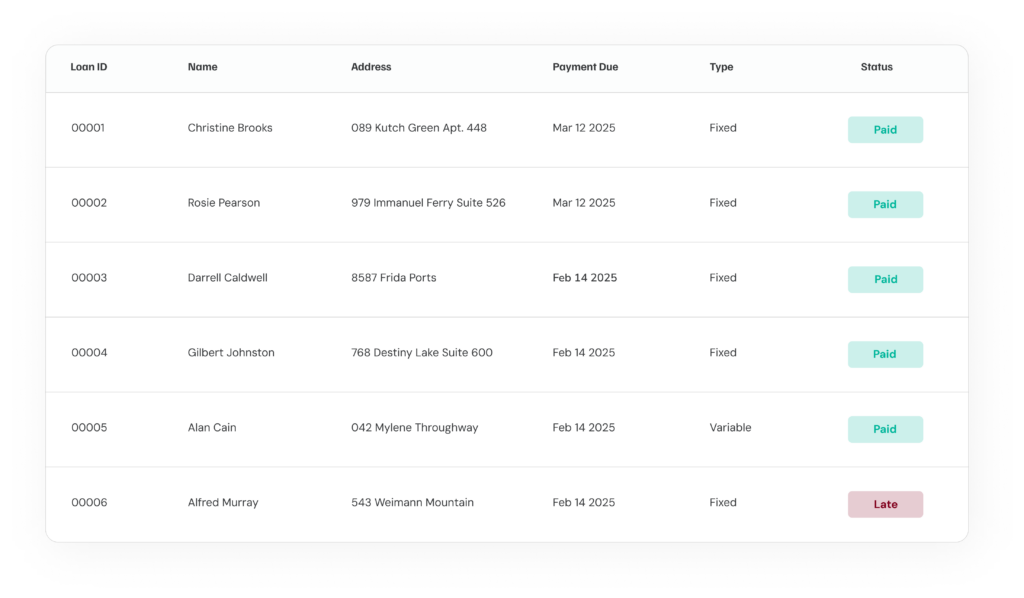

From non-performing mortgages to charged-off consumer loans, Nortridge supports the full spectrum of distressed debt portfolios. Manage complex workout strategies, multiple collateral types and intricate payment arrangements all on one platform.

Automate Your Recovery Process

Ditch those spreadsheets and manual tracking systems. Automate payment waterfalls, fee assessment and collection workflows. Set up custom triggers based on payment behavior and let the system handle routine tasks while your team focuses on higher-value recovery activities.

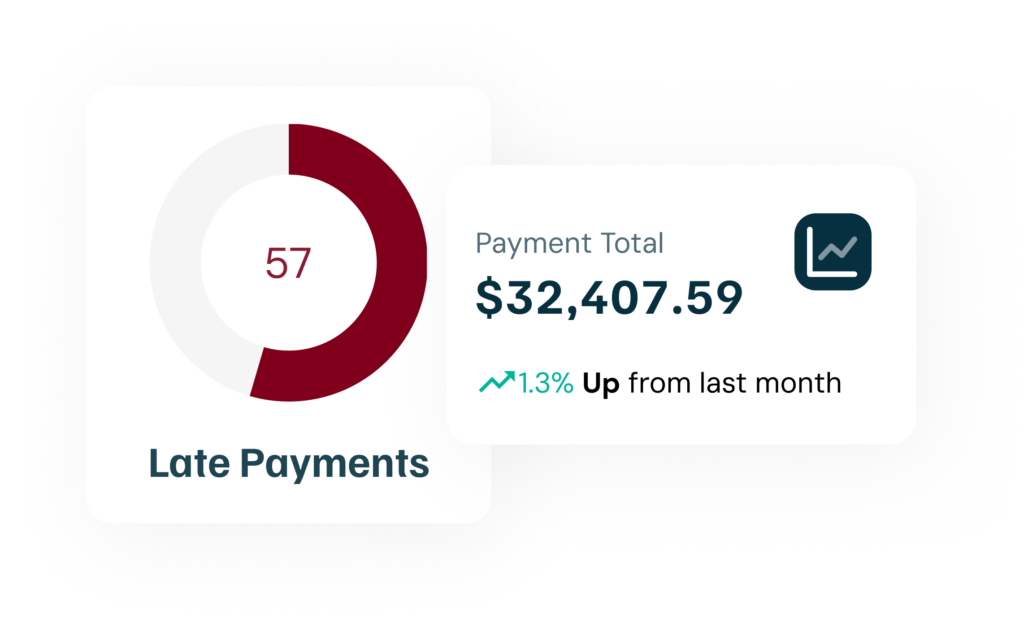

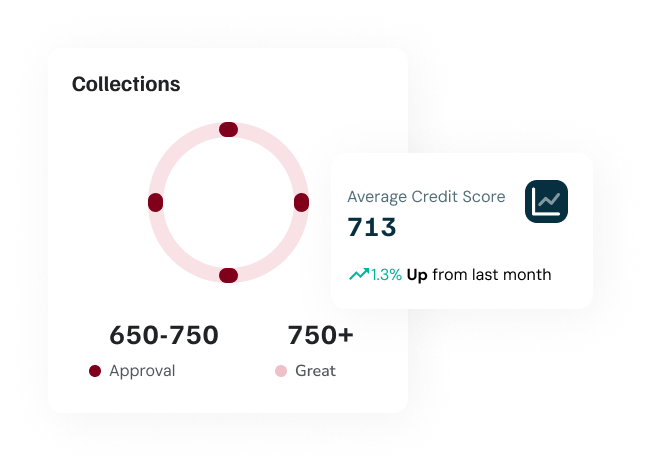

Powerful Portfolio Insights

Make smarter investment decisions with detailed analytics showing recovery rates, cost-to-collect metrics and profitability by portfolio segment. Generate configurable reports on performance, trends and forecasts to optimize your distressed debt strategy.

Transform Your Distressed Debt Management with Nortridge

Ready to boost your recovery rates? Let our team show you how Nortridge handles the unique challenges of distressed debt – from tracking multiple asset values to streamlining complex workouts – with a personalized demo tailored to your portfolio.

Frequently Asked Questions

How does Nortridge handle multiple valuation methods for distressed assets?

Our system allows for the tracking of contract balances, purchase costs, charge-off values and current market valuations for each asset. This gives you a complete financial picture and helps calculate actual returns on your investments.

Can I track expenses related to maintaining distressed assets?

Absolutely. The system categorizes protective advances as reimbursable or non-reimbursable, helping you monitor maintenance costs for properties, legal expenses and other outlays that impact your net recovery.

How does collateral tracking work for distressed portfolios?

You can track unlimited collateral items per loan, including real estate, vehicles and other assets. The system maintains valuation history, insurance information, tax data and lien positions for comprehensive collateral management.

Can Nortridge handle complex loan restructuring scenarios?

Yes. Our system excels at loan modifications, workout agreements and complex restructuring scenarios. You can easily adjust terms, implement step payments or create custom payment arrangements to maximize recovery.

Does Nortridge offer multi-book accounting for distressed debt?

Yes, our system supports multi-book accounting and shadow loans, allowing you to maintain separate sets of financial records for regulatory reporting, investor communications and internal performance analysis.

Our Latest Testimonials

Trust Nortridge For Your Distressed Debt Management

Stop struggling with cobbled-together spreadsheets and outdated systems. Our comprehensive platform delivers the specialized tools distressed debt professionals need, from purchase cost tracking to collateral management, giving you complete control over your non-performing portfolio.