Commercial Lending Software

Elevate your commercial lending business with our enterprise-grade platform, engineered to handle complex business loans and scale with your portfolio.

Transform Your Commercial Lending Services

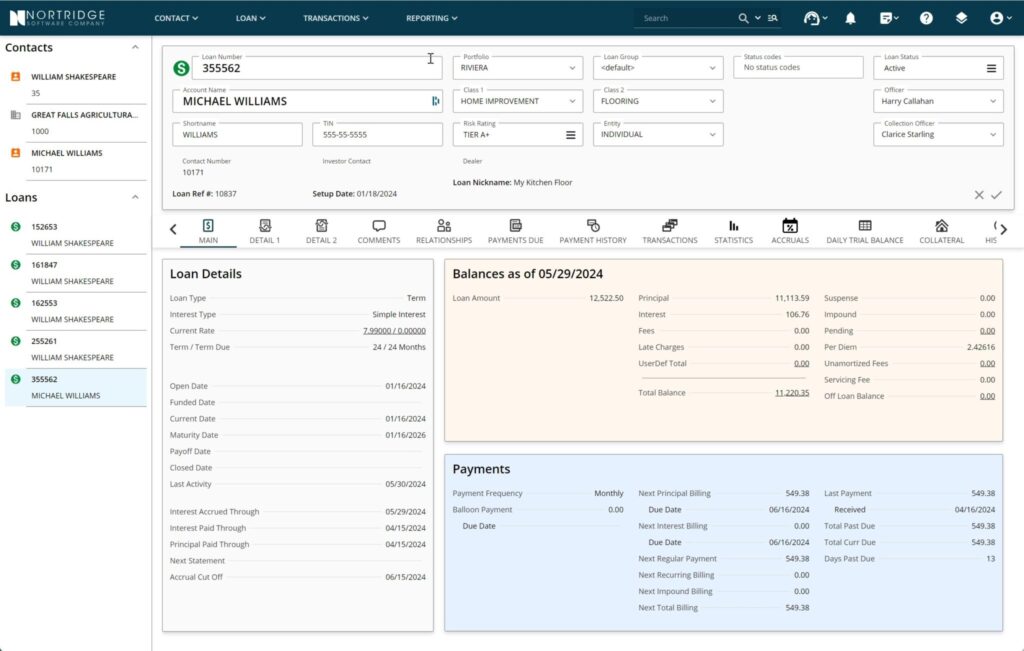

Comprehensive Loan Management

Flexible Portfolio Oversight

Credit Bureau Integration

Payment & Fee Management

Manage complex fee structures, including amortized fees, payment schedules and escrow accounts with precision. Our system handles: multi-tiered late charges, multiple variable rate structures and payment frequencies and detailed transaction histories. Maintain accurate loan balances and automate payment applications.

Enterprise Reporting

Leverage any of our 150+ standard reports or utilize our robust enterprise reporting system for your unique commercial lending business. Our reporting system lets you analyze portfolio data, track loan performance and maintain audit trails. Generate detailed analytics and stakeholder reporting while automating report distribution.

Data Export

We provide access to all raw data. Connect your favorite data analytic tools directly to our database and transform loan data into actionable insights. For customers using data warehouses, we offer simple export and synchronization of data to your warehouse directly from our system of record.

Document Management

Store and manage commercial lending documentation securely in our system. Track agreements and collateral files with our organized filing structure. Maintain and access critical documents while following your document retention requirements.

Frequently Asked Questions

How does Nortridge handle complex commercial loans?

Our platform supports varied payment structures, multiple collateral types, and sophisticated fee calculations for commercial lending services.

What security features are included?

Our commercial lending software provides enterprise-grade security with role-based access controls and user activity monitoring.

Can Nortridge support multiple business loan types?

Our system handles diverse commercial lending products, from equipment financing to complex business lines of credit and commitments.

How configurable is the platform?

Configure every aspect of the commercial lending platform to match your specific business workflows and requirements.

What integration capabilities are available?

Our APIs enable secure integration with payment processors and support connectivity with major credit bureaus. We facilitate real-time data exchange for payment processing, credit pulling and reporting functions.

Our Latest Testimonials

Nortridge’s Commercial Lending Edge

Only the best commercial lending software can combine flexible configuration with proven servicing capabilities. Nortridge delivers on this, with tools commercial lenders need to manage complex portfolios while maintaining scalability. Through customizable workflows and comprehensive reporting, we empower commercial lending businesses to grow efficiently.