When selecting loan management software for your lending business, it’s crucial to find a solution that meets your specific needs. The right loan software can streamline operations, ensure compliance, and enhance customer service. Nortridge Loan System stands out with its flexible features, making it a top choice for various lending requirements. This article will discuss essential factors to consider, such as scalability, integration, security, and support, and illustrate how Nortridge excels in these areas.

Key Considerations in Choosing Loan Management Software

When shopping for software for loan management, consider the following features to ensure the solution meets your business needs. Here’s how Nortridge Loan System excels in these areas:

Scalability

Scalability ensures that the software can grow with your business, accommodating increased loan volumes and expanding functionalities without compromising performance.

Growth Adaptation

Scalable solutions can handle more transactions and integrate new features as your business grows. Nortridge efficiently scales with your business, managing increased transactions and user loads seamlessly.

Load Balancing

Efficiently distributes workloads across servers to maintain performance during peak times. Nortridge uses load balancing to ensure smooth operations, even during high-traffic periods.

Modular Architecture

Allows for adding new features or modules without disrupting existing operations. Nortridge’s modular design supports the addition of new functionalities, enabling seamless expansion.

Cloud-Based Solutions

Provides flexible resource allocation, enabling easy scaling up or down based on demand. Nortridge offers cloud-based options that adapt to your business’s needs.

Integration Capabilities

Integration capabilities enable the software to work seamlessly with existing systems, enhancing overall operational efficiency.

System Compatibility

Ensure your software for loan management integrates with accounting, CRM, and payment processing systems. Nortridge integrates effortlessly with these systems, ensuring smooth data flow.

API Support

Robust API support allows for easy integration with third-party applications, enhancing functionality.

Security Features

Robust security measures are essential to protect sensitive data and ensure compliance with industry regulations.

Data Protection

Look for strong encryption and multi-factor authentication to secure borrower information. Nortridge employs 256-bit encryption and multi-factor authentication to safeguard data.

Compliance

Ensure the software complies with regulations to mitigate legal risks and maintain data integrity. Nortridge complies with industry standards, ensuring regulatory adherence.

User Support

Comprehensive user support ensures that your team can effectively utilize the software and resolve any issues promptly.

Training and Onboarding

Effective training programs help your team get up to speed with the new software quickly. Nortridge offers extensive training programs to ensure efficient use.

Ongoing Assistance

Reliable customer support for troubleshooting and regular updates is essential for smooth operations. Nortridge provides ongoing support and regular software updates.

Optimize Your Loan Management with Nortridge

The right loan management software is crucial for enhancing operational efficiency and ensuring long-term success. Nortridge Loan System offers comprehensive features, robust security, and excellent support, making it an ideal choice for lenders.

Take the next step in optimizing your lending operations with Nortridge. Contact us today to learn more.

Evaluating Loan Management Software

Choosing the right software for loan management requires a thorough evaluation of various aspects to ensure it meets your business needs. Let’s look at how Nortridge excels in each key area.

Feature Set

Essential features are crucial for handling all aspects of loan management effectively. Advanced tools enhance functionality and improve operational efficiency.

Core Functionality

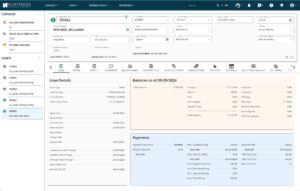

Nortridge offers comprehensive loan origination, servicing, and collection capabilities. These core functionalities ensure that all aspects of loan management are covered, from the initial application to final repayment.

Advanced Tools

Nortridge includes advanced features like automated workflows, real-time reporting, and risk management tools. These tools streamline processes, provide actionable insights, and help manage risks effectively, making your operations more efficient and effective.

User Interface and Ease of Use

An intuitive design is vital for enhancing productivity and reducing errors. A user-friendly interface makes it easier for staff to navigate and use the software efficiently.

Intuitive Design

Nortridge boasts a simple, clear interface that reduces the learning curve and improves user experience. The design is user-centric, ensuring that even new users can quickly get up to speed.

Productivity Impact

The ease of use minimizes errors and speeds up loan processing tasks. Nortridge’s intuitive interface helps staff complete tasks more quickly and accurately, leading to higher productivity and job satisfaction.

Cost Considerations

Understanding the pricing structure and assessing the return on investment (ROI) are crucial for making a cost-effective decision.

Pricing Structure

Nortridge offers flexible pricing models tailored to different business needs. Evaluating this structure helps you understand all costs involved, including any hidden fees.

ROI Assessment

The potential ROI is significant with Nortridge due to improved efficiency, reduced errors, and enhanced customer satisfaction. By streamlining operations and reducing manual tasks, Nortridge can deliver substantial cost savings and operational benefits.

Reviews and Testimonials

User feedback is essential for evaluating the performance, reliability, and customer support of the software.

User Feedback

Nortridge has received positive reviews and testimonials from current users, highlighting high satisfaction levels. These reviews reflect real-world performance and reliability.

Performance and Support

Nortridge is praised for its reliability and exceptional customer support. Users appreciate the prompt and effective assistance they receive, ensuring smooth operations and quick issue resolution.

Choose the Right Loan Management Software Today

Choosing the right loan software is critical for optimizing your lending operations. It’s important to consider scalability, integration capabilities, security features, and user support. Nortridge Loan System excels in all these areas, making it an ideal choice for lenders.

Nortridge offers robust scalability to grow with your business, seamless integration with various financial systems, strong security measures, and comprehensive user support. These features ensure that your operations are efficient, compliant, and ready for future growth.

Take the next step in enhancing your lending operations with Nortridge. Contact us today to learn more about our innovative solutions.